This was back when PayPal was a growing subsidiary in the eBay behemoth, which it split from in 2015. A few months after it officially launched, online payments provider Braintree acquired it for $26.2 million.Ī year later, PayPal agreed to an $800 million purchase of Braintree, which included Venmo. It took almost three years for Venmo to launch publicly, although iPhone and Android users could join through the app by September 2011. ✓ Fully transparent ✓ Global reach ✓ Top exchanges integration ✓ Smart retargeting & deep segmentation ✓ Your first party data maximized ✓ Fully managed / self-served Get started There is no charge as long as the application, which is available on iOS and Android, is connected directly to the bank account or, unlike PayPal or Google Wallet, to the debit card.Zoomd’s DSP: Masterful UA meets smart retargeting The receiver then only has to confirm the transaction. The debtor selects the creditor on his Venmo network, by e-mail address or phone number, enters the amount and the reason for the transfer and presses "send". They can also make their transactions public and share what they bought when and where. Users can send chat messages with emoticons to the recipient of the money.

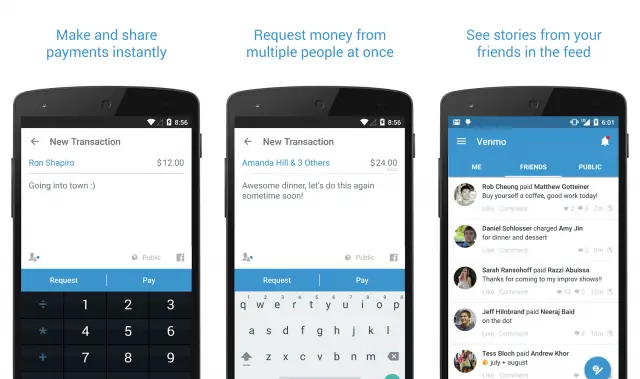

Venmo gives users the ability to pay for goods and services in registered businesses using a bank account or credit card. The Venmo application that makes it possible to use its services is much faster than normal bank transfers and is also simpler. It is a major undertaking with a turnover of more than $1.5 billion per year. Venmo is a mobile payment service officially launched in early 2012. Venmo, a simplified financial transaction network Venmo can only be used in the United States, but that hasn't stopped it from reading more than 200 million Venmo transactions. With this tool, registered users can send and receive money as well as pay for purchases.

Venmo is part of PayPal's myriad of mobile payment applications designed to simplify financial transactions.

0 kommentar(er)

0 kommentar(er)